Hello friends, Today in this article we will discuss briefly about Pension. As per rule 1.1(a) of the Punjab Civil Service Rules volume II, the rules in this volume regulate the grant of pensions to the members of State Servies Group A, B, C and D. As you know from 01-01-2004 all of the state government employees are covered under the new defined contributory pension scheme, so pension rules contained in volume II are not applicable to them.

- What is a Pension?

- What is the minimum service to qualify for a pension?

- When will an employee be entitled to a full pension?

- What are the types of pension?

- Can a pension be recovered?

- What is the qualifying service and how the service qualifies for the pension?

- How the pension is fixed?

Let's discuss all of the above one by one:-

What is a Pension?

Pension is a monthly payment made to a government employee in lieu of 10 or more years of qualifying service rendered by him before his retirement. The exact definition of pension is given in rule 2.45 of the Punjab CSR volume I part I.

What is the minimum service to qualify for a pension?

A minimum of 10 years of qualifying service is required to qualify for a pension. An employee who has less than 10 years of qualifying service then he shall be entitled only for service gratuity calculated at the uniform rate of half month‟s emoluments for every completed six monthly periods of service.

{Rule 6.16 A of the Punjab Civil Service Rules Volume II}

When will an employee be entitled to a full pension?

Full pension to a Government employee shall be admissible after rendering a qualifying service of twenty-five years. If the qualifying service is less than 25 years then proportionate less pension will be admissible.

{Rule 6.16-A(1) of the Punjab Civil Service Rules Volume II}

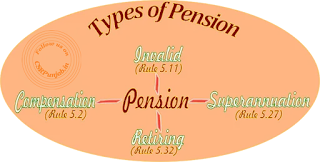

Pensions are divided into four classes that are Compensation Pension, Invalid Pension, Superannuation Pension and Retiring Pension. let's study those in brief:-

|

| Types of Pension |

Compensation Pension

Compensation Pension means a pension granted to a government employee who has 10 or more years of qualifying service and is retired due to the abolition of the post held by him.

{Rule 5.2 of the Punjab Civil Service Rules Volume II}

Invalid Pension

Invalid Pension is a pension granted to a government employee who has been bodily or mentally incapacitated for further government service and is therefore retired.

{Rule 5.11 of the Punjab Civil Service Rules Volume II}

Superannuation Pension

Superannuation Pension means a pension granted to a government employee who has 10 or more years of qualifying service and is retired on attaining the age of superannuation as per rule 3.26 of the Punjab CSR volume I part I.

{Rule 5.27 of the Punjab Civil Service Rules Volume II}

Retiring Pension

Retiring Pension means a pension granted to a government employee who retires voluntarily on attaining the age of 50 years or having 20 years of qualifying service or to a government employee who is retired compulsorily due to bad record on attaining the age of 50 years or having 25 years of qualifying service.

{Rule 5.32 of the Punjab Civil Service Rules Volume II}

Can a pension be recovered?

According to rule 2.2(a) of the Punjab Civil Service Rules Volume II, The pension granted to a retired Government employee can be withheld or withdrawn by the Government if he is convicted of a serious crime or found guilty of grave misconduct, as the continuance of drawl of pension requires future good conduct of the pensioner.

Whereas as per note under rule 2.2(a) of ibid, Recovery of other Government dues such as over issues of pay, allowances or leave salary or admitted and obvious dues such as house-rent, Postal Life Insurance premia, outstanding motor car, house building, traveling allowance or other advances and recovery of non-Government dues may not be affected by a reduction of the pension until any request made by the retire himself or consent given has agreed that the recovery may be made.

In case retire does not agree to the recovery of amount admittedly due to Government, the authority concerned is to consider to make recovery by going to a court of law, if necessary.

Also as per provisions of rule 2.2(b) of ibid, the Government cannot make recovery from the pension at a stage when departmental/judicial proceedings to prove the negligence of the employee cannot be instituted for an event that took place more than 4 years ago.

What is qualifying service and how the service qualifies for the pension?

Qualifying service means the service rendered while on duty and it will be considered for the purpose of grant of pension. As per rule 3.8 of the Punjab Civil Service Rules Volume II, the service of every Government employee begins to qualify for the pension when he takes charge of the post to which he is first appointed. Also as per rule 3.9 of ibid, the boy service that is the service below the age of 18 years does not qualify for the pension.

According to rule 3.12 of ibid, The service of a Government employee does not qualify for pension unless it conforms to the following three conditions:–

- The service must be under Government.

- The employment must be substantive and permanent.

- The service must be paid by the Government.

Additions to service qualifying for Superannuation Pension

As per rule 4.2(4) of the Punjab Civil Service Rules Volume II, an employee shall be eligible to add to his service qualifying for superannuation pension a period of five years if he or she is blind, deaf, dumb or otherwise orthopedically handicapped or widow at the time of his entry into Government Service.

Vide rule 4.2(5) of ibid, an employee shall be eligible to add to his service qualifying for superannuation pension a period of five years if he or she is blind, deaf, dumb or otherwise orthopedically handicapped during the service and is retired from the service due to these reasons.

Also, an employee who retired voluntarily shall be eligible to add to his service qualifying for superannuation pension a period of five years as per premature retirement rules 1975(appendix 22 of the Punjab CSR volume 1 part 1).

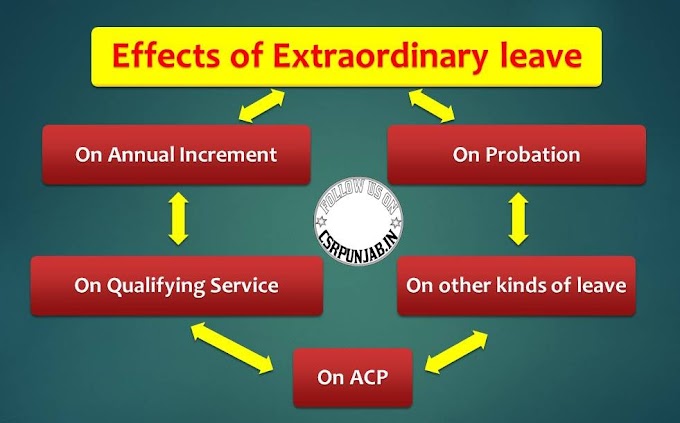

Period of leave that counts as service qualifying for Pension

All kinds of leave except extraordinary leave taken otherwise than on medical grounds shall count as service qualifying for Pension as per rule 4.7 of ibid. Also, the period of overstayal of leave does not count as service qualifying for pension as per rule 4.10 of ibid.

In other words, all the periods of service that do not count for increments under rule 4.9(b) of the Punjab Civil Service Rules volume 1 part 1 shall not count as service qualifying for Pension also.

How the Pension is fixed?

As per rule 6.1 of the Punjab Civil Service Rules Volume II, the amount of Pension that may be granted is determined by the length of service. The fraction of a year equal to three months and above shall be treated as a completed six-monthly period for the purpose of calculation of any pension.

Rounding off the amount of Pension

As per rule 6.2 of ibid, Pension fixed in rupees should be rounded off to the next higher rupee means if there is any remainder during the calculation of pension, it should be rounded off to next higher rupee.

For example, if the pension of a retired government employee was worked out to Rs. 21,127.11 then it will be rounded off to 21,128.

Fixation of Pension

According to rule 6.16-A of ibid, shall be calculated at the rate of fifty percent of emoluments or average emoluments, whichever is more beneficial to him. As per proviso below rule 6.16-A, the pension so calculated shall, in no case be, less than three thousand and five hundred rupees per month.

Let's solve a practical question to understand the fixation of Pension:-

Ques: Calculate the pension of an employee from the following particulars:-

(a)Date of Retirement: 31-03-2013.

(b) Date of Joining: 29-03-1985.

(c) Taken EOL without a medical certificate from 1-1-1990 to 31-12-1990.

(d) Taken EOL with a medical certificate from 1-10-1998 to 15-12-1998.

(e) Taken Earned Leave from 01-10-2012 to 31-12-2012.

(f) Drawing basic pay Rs. 13910/- ( Pay band 10710+ Grade pay 3200) in the pay scale 10300-34800+3200 at the time of retirement.

Ans: First of all we have to find out the Net qualifying service. so we will solve the question like this:-

Date of Joining: 02-03-1985

Date of Retirement: 31-03-2013

Gross Service= 28 Years & 29 days.

Now we will calculate Non-qualifying service

EOL without medical certificate= 1-1-1990 to 31-12-1990= 1 Year

Now net qualifying service= 27 Years & 29 days.

And completed half yearlies = 54

So Basic Pension= 13910x50/100= Rs. 6955/-

Thus the basic pension of the retired government employee is Rs. 6955/-. After this admissible dearness allowance will be calculated on this amount and medical allowance of Rs. 500 will be given to a retiree. Thus you will find total monthly Pension payable to a retired government employee.

In the end, we hope this article will help you a lot. Please post your queries and suggestions in the comment box.

You can also check Frequently asked questions, Income tax Calculator, Technical Resignation

Please Follow this website for the latest updates.

In the end, we hope this article will help you a lot. Please post your queries and suggestions in the comment box.

You can also check Frequently asked questions, Income tax Calculator, Technical Resignation

Please Follow this website for the latest updates.

![Joy to Unicode Converter[Convert Joy font to Unicode Font]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEh3f8Zg_5htGD-hVKzVHogU5W5OWZ5UtcKdg97w_pk3C20rO_YjhEiIh2PJtq34jm82Ao-puIVE2hvXwasUYc12w-1Vu5C_ytqbKjHJ_79U9tarTLJbzbR3VSDpCtqKk4QsjxVJTTxZF70/w680/joy-to-unicode-converter.webp)

2 Comments

Kindly show some example questions on voluntary retirement please.

ReplyDeleteKindly post more examples. It's very nice pls post more content

ReplyDelete