To start with, let’s first understand the term LTC. LTC stands for Leave Travel Concession. LTC is a reimbursement given by an employer to an employee for meeting traveling expenses for the journey performed in any place in India or for traveling to home town.

In this article, we will discuss Leave Encashment on LTC for the journey performed anywhere in India in detail.

|

| 10 days Leave Encashment on availing LTC |

In this article, we will discuss Leave Encashment on LTC for the journey performed anywhere in India in detail.

Commencement of LTC

If we talk about the commencement of LTC then Punjab Government has allowed LTC to the state government employees for visiting home town once in a block of Two years as per circular no. 2829-GI-57/6828 dated 26/28 May 1957.

After this On the recommendations of Third Punjab pay commission, Punjab Government decided that the facility of LTC for visiting home town/any place in India available to the employees of the Central Government be extended to the State Government employees and members of their families by its letter no. 6/10/88-6GE/3299 dated 9-3-1989.

LTC for journey to any place in India in the every block of 4 calendar years commencing from 1990, the first block being 1990-1993. If it is not utilized during a certain block of four years, it can be carried forwarded to the first year of the subsequent block of four years with the permission of the Head of Department.

Annexure 'A' for availing of LTC

|

| Annexure 'A' for availing of LTC |

Annexure 'A' is a proforma or we can say it is an application format for availing of Leave Travel Concession i.e LTC. Annexure 'A' is shown in the picture below and you can also download it in pdf format from the link provided at the end of this article.

LTC block year of Punjab Govt.

As we have discussed above, the first block of four years of LTC to any place in India started in 1990. This means the first block is 1990-1993 and the second is 1994-1997 and the third is 1998-2001 and so on. The current block of LTC is 2018-2021.

Can LTC be availed on Casual Leave?

The answer to the question is yes. Of course, LTC can be availed on casual leave or regular as the case may be irrespective of the duration of the leave. Let's discuss leaves in which LTC is admissible and in which it is not admissible to the state government employees.

Leave in which LTC is admissible

- Earned Leave

- Half Pay Leave/Without pay leave

- Maternity Leave

- Study Leave

- During Casual Leave

- While on deputation

- While under training

- During Vacation, in vacation Departments

Leave in which LTC is not admissible

- Weekend holidays

- During Terminal Leave

- During any leave taken on medical ground

- While under suspension

- During Refused or Terminal Leave

Encashment of earned leave on availing LTC

From 1st October

2011, encashment of earned leave along with LTC had been started. On the recommendations of the Fifth Punjab Pay Commission, the Government of Punjab, Department of Finance vide its Letter No.1/16/2011-3FP2/617 Dated: 03-10-2011 decided that the state Government employees will be entitled to encash 10 days earned leave at the time of availing LTC subject to some conditions.

Later on, the above letter is updated as rule 8.22 of Punjab civil service rules volume 1 part 1 in the newly published Punjab Civil Service Rules, which was published in the year 2016.

How many leaves can be Encashed?

As per rule 8.22 of Punjab Civil Service Rules volume 1 part 1, A Government employee may be permitted to encash earned leave up to ten days at the time of availing of Leave Travel Concession while in service, subject to the condition that the total earned leave so encashed during the entire service career shall not exceed sixty days in the aggregate.

Can both husband and wife claim Leave encashment on LTC?

The answer to the question is Yes. Means, if husband and wife both are government employees then 10 days encashment of leave will be admissible to both of them subject to the condition of 60 days in entire service career in each case(Rule 8.22(5)).

Can encashment of 10 days be deducted from the maximum amount of earned leave encashable at the time of retirement?

Sometimes employees are afraid that if they have taken 10 days encashment of leave then it will be deducted from the maximum amount of earned leave encashable at the time of retirement. But the fact is that The leave so encashed shall not be deducted from the maximum amount of earned leave encashable at the time of retirement under rule 8.21.

How is leave encashment calculated in LTC?

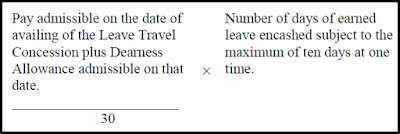

As per rule 8.22(3) of Punjab Civil Service Rules volume 1 part 1, Leave encashment of 10 days earned leave on availing LTC is calculated as shown in the picture:-

|

| Formula to Calculate 10 days leave encashment |

The leave encashed under this rule shall be debitable to the leave account of the Government employee.

Is LTC leave encashment taxable?

Yes, the earned leave encashed during the service period is taxable. It means you have to pay the proportionate tax as per your income slab in the relevant assessment year.

Conclusion:-

- LTC can be availed in every block of 4 calendar years.

- If it is not utilized during a certain block of four years, it can be carried forwarded to the first year of the subsequent block of four years.

- LTC can be availed on a casual leave.

- LTC cannot be availed on weekend holidays.

- The leave encashed shall be debitable to the leave account of the Government employee.

- The total earned leave so encashed during the entire service career shall not exceed sixty days.

- The leave so encashed shall not be deducted from the maximum amount of earned leave encashable at the time of retirement.

- The amount of leave encashment of 10 days earned leave is taxable.

![Joy to Unicode Converter[Convert Joy font to Unicode Font]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEh3f8Zg_5htGD-hVKzVHogU5W5OWZ5UtcKdg97w_pk3C20rO_YjhEiIh2PJtq34jm82Ao-puIVE2hvXwasUYc12w-1Vu5C_ytqbKjHJ_79U9tarTLJbzbR3VSDpCtqKk4QsjxVJTTxZF70/w680/joy-to-unicode-converter.webp)

10 Comments

Ltc related government da circular mil jau jish vich sari information hove

ReplyDeleteYou can purchase a book of LTC related instructions from Sector 17 Book shop

DeleteYes you are entitled for 10 days leave encashment but not TA Claim

ReplyDeletecan i avail LTC if i got 2 days Casual leave and 2 days gazetted holiday and travel with personal vehicle?

ReplyDeleteYes you can avail

DeleteCan a employee under probation period avail LTC??

ReplyDeleteNo not elgible

DeleteHello,

ReplyDeleteI applied for LTC in 2021 but due to some reasons the processing is being done now late & my bill has been prepared & pending to be sent to treasury

now my office is saying that you have attached only train tickets but no staying proof of that place. I stayed at my relatives house & i don't have any other proof. Can only train tickets be accepted ??

During the block of 2018 -2021 i didn't avail LTC .....now during the next block 2022-2025 can i avail LTC twice ?

ReplyDeleteBefore how many days need to to apply for Ltc?

ReplyDelete